Ct State Tax Form 2025. Estimate your tax liability based on your income, location and other conditions. Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income.

Connecticut’s 2025 income tax ranges from 3% to 6.99%. As a result of fiscal responsibility and bipartisanship in 2025, i am pleased to announce that significant relief is on the way for many connecticut taxpayers in 2025!

To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025.

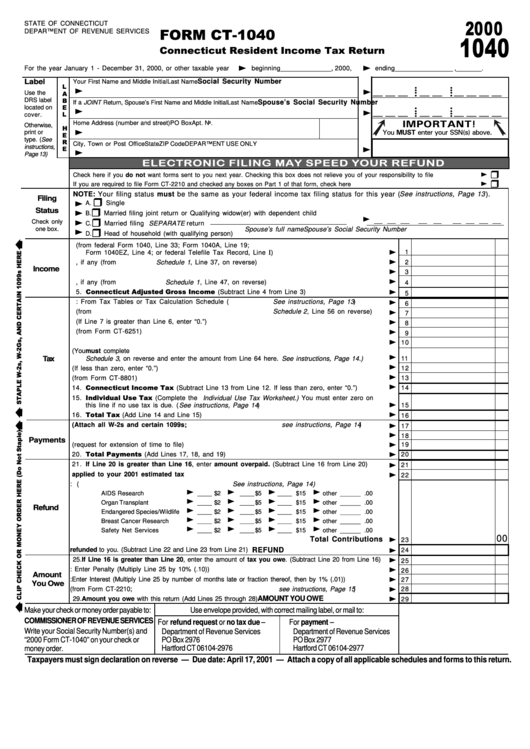

Ct 1040 Form Fillable Printable Forms Free Online, Many in connecticut will see tax cuts in 2025. But lawmakers modified that in this year’s state budget, and beginning in the 2025 tax year, some retirees with higher earnings will qualify for exemptions on a sliding.

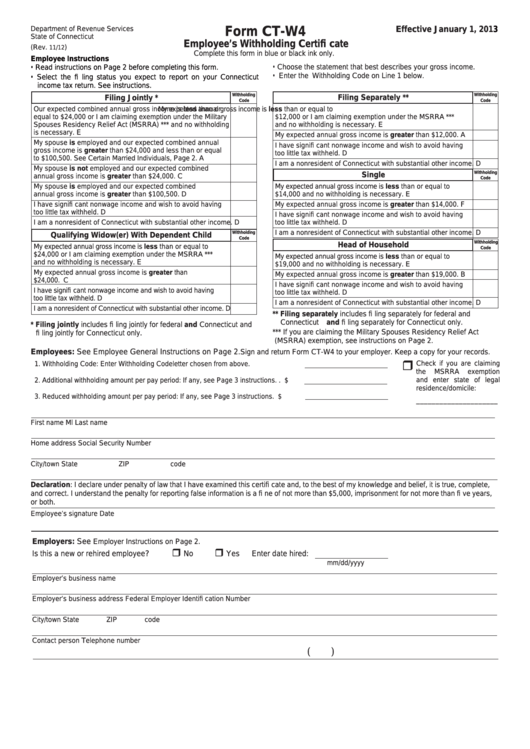

Ct State Tax Withholding Forms, Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2025, including reduced income. Calculate your income tax, social security.

Ct State Tax Form Withholding, To estimate your tax return for 2025/25, please. Calculate your income tax, social security.

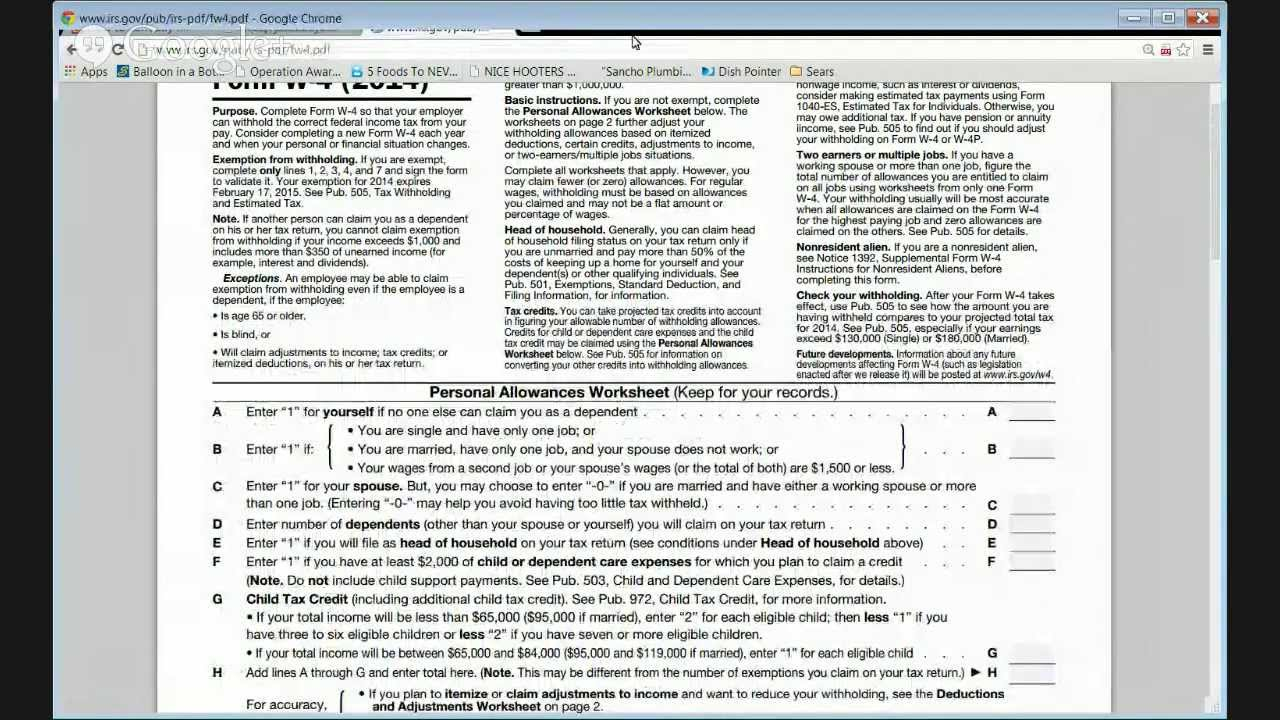

Printable W4 Forms, File your 2025 form ct‑706/709 on or before april 15, 2025. December 26, 2025 · 5 minute read.

What Is Ct State Tax The connecticut state sales tax rate is 6.35, Estimate your tax liability based on your income, location and other conditions. Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2025 income tax rates in connecticut.

Oklahoma Tax Form 2025 Printable Forms Free Online, Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2025 income tax rates in connecticut. December 26, 2025 · 5 minute read.

What Is Ct State Tax The connecticut state sales tax rate is 6.35, December 26, 2025 · 5 minute read. Many in connecticut will see tax cuts in 2025.

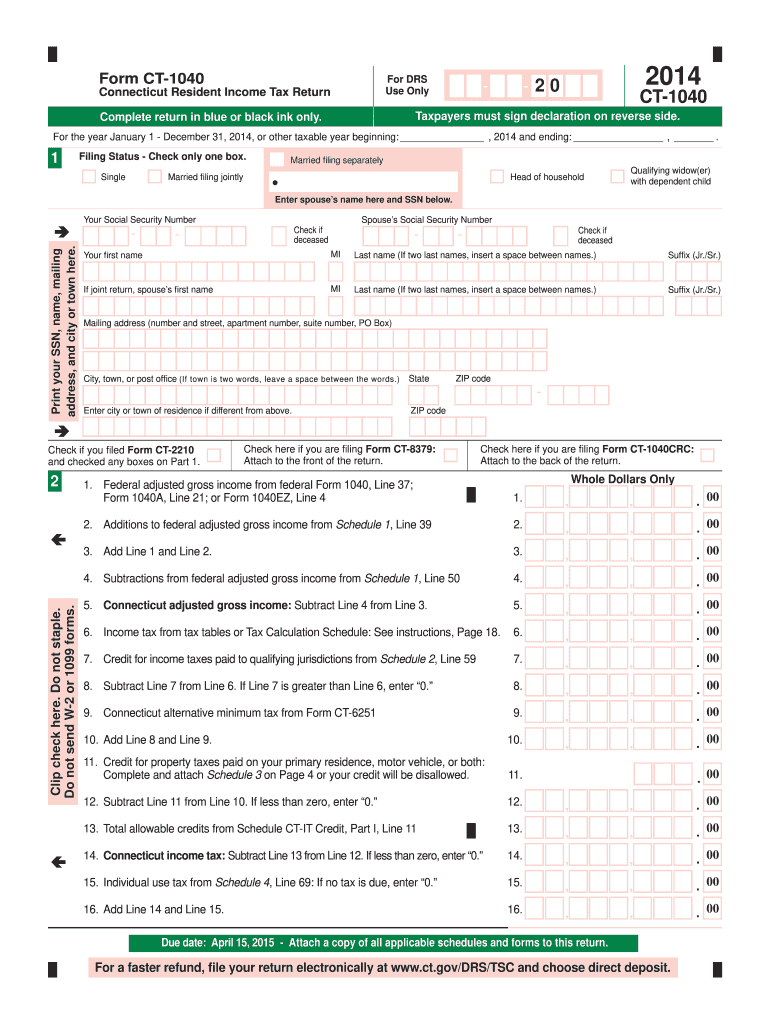

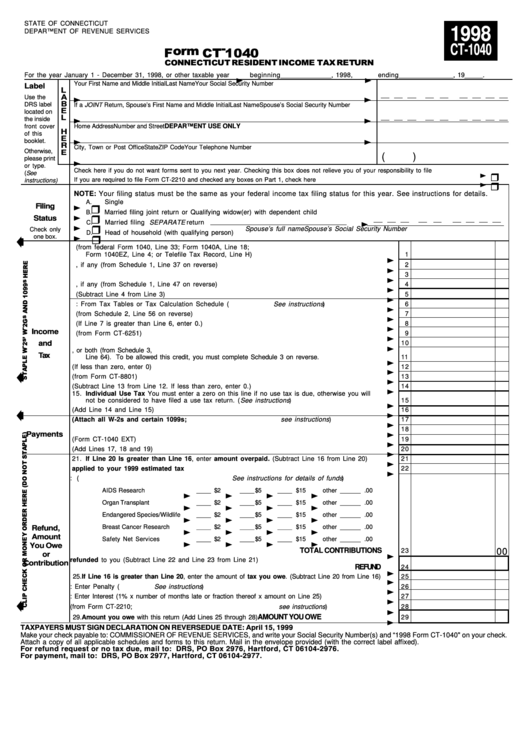

2014 ct 1040 form Fill out & sign online DocHub, Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2025 income tax rates in connecticut. But lawmakers modified that in this year’s state budget, and beginning in the 2025 tax year, some retirees with higher earnings will qualify for exemptions on a sliding.

Ct state tax form 2025 Fill online, Printable, Fillable Blank, To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025. Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail.

Fillable Form Ct 1040 Connecticut Resident Tax 1040 Form Printable, Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail. Withholding information for connecticut residents who work in another state.

Calculate your annual salary after tax using the online connecticut tax calculator, updated with the 2025 income tax rates in connecticut.